charitable gift annuity tax deduction

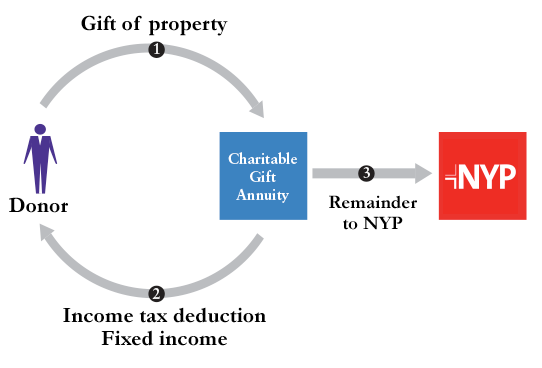

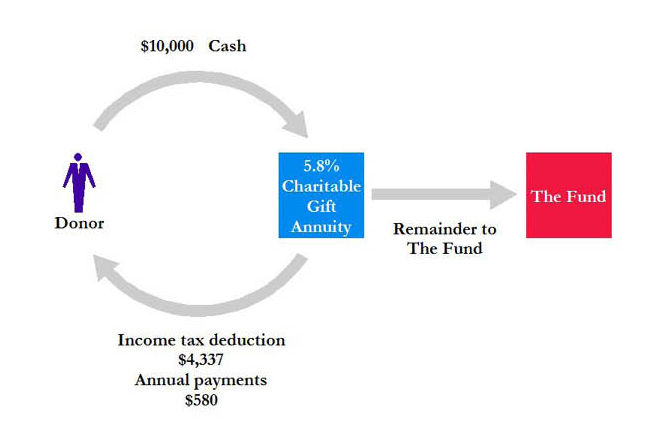

The donor makes a considerable gift to the charity via cash security or other. Ad Learn how to give to your favorite charities and maximize tax benefits.

Charitable Gift Annuity Tprf Org

Ad Earn Lifetime Income Tax Savings.

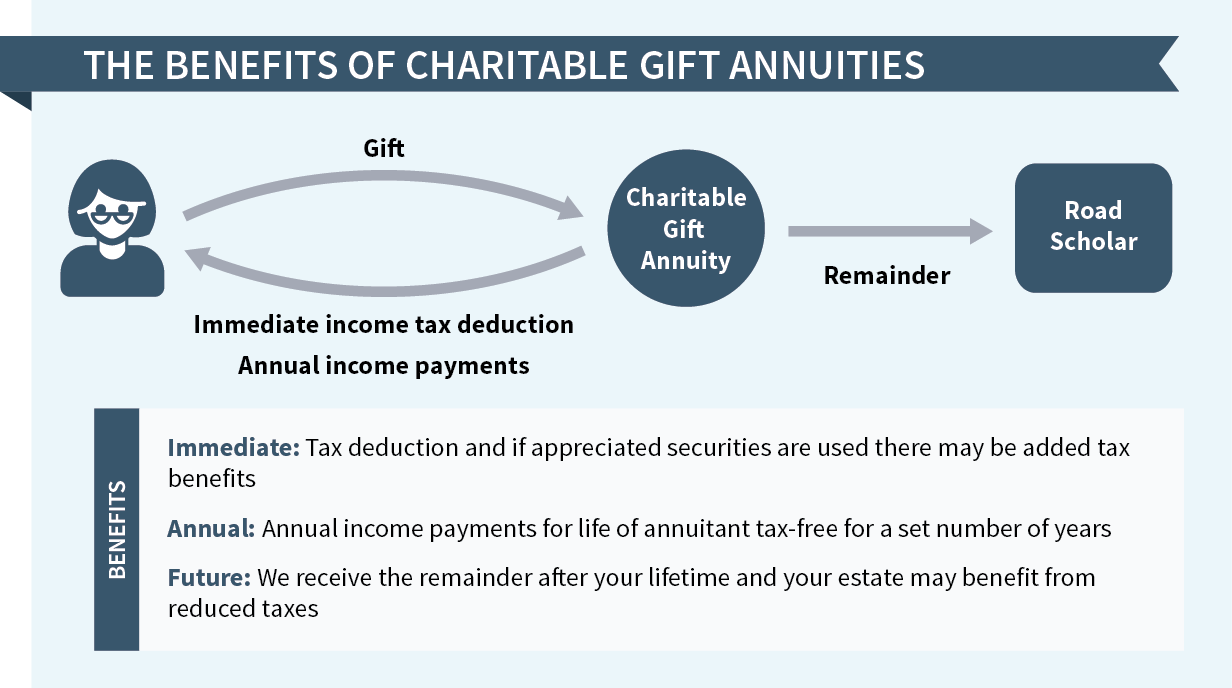

. Visualize trends in state federal minimum wage unemployment household earnings more. The income tax charitable deduction for a gift annuity is less than the amount of the gift donated. Key benefits of charitable gift annuities Secures a source of lifetime income.

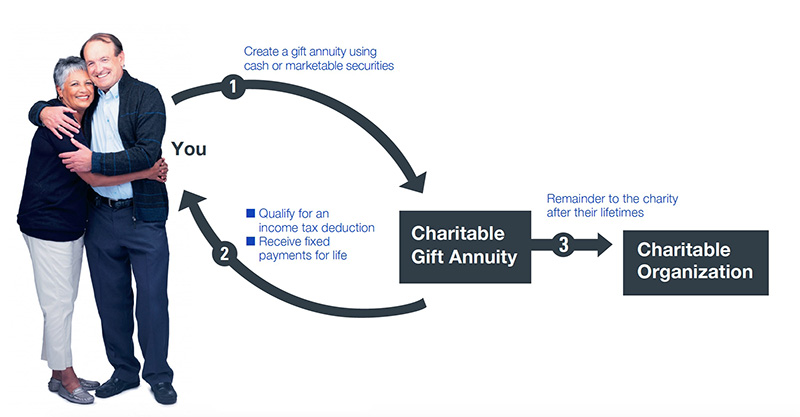

282 holds that if a donor makes a gift to a charitable organization and in return receives an annuity from the charity payable for his or her lifetime from the general. 7 rows A charitable gift annuity is a way to donate to a nonprofit and receive a stream of lifetime. With TurboTax Its Fast And Easy To Get Your Taxes Done Right.

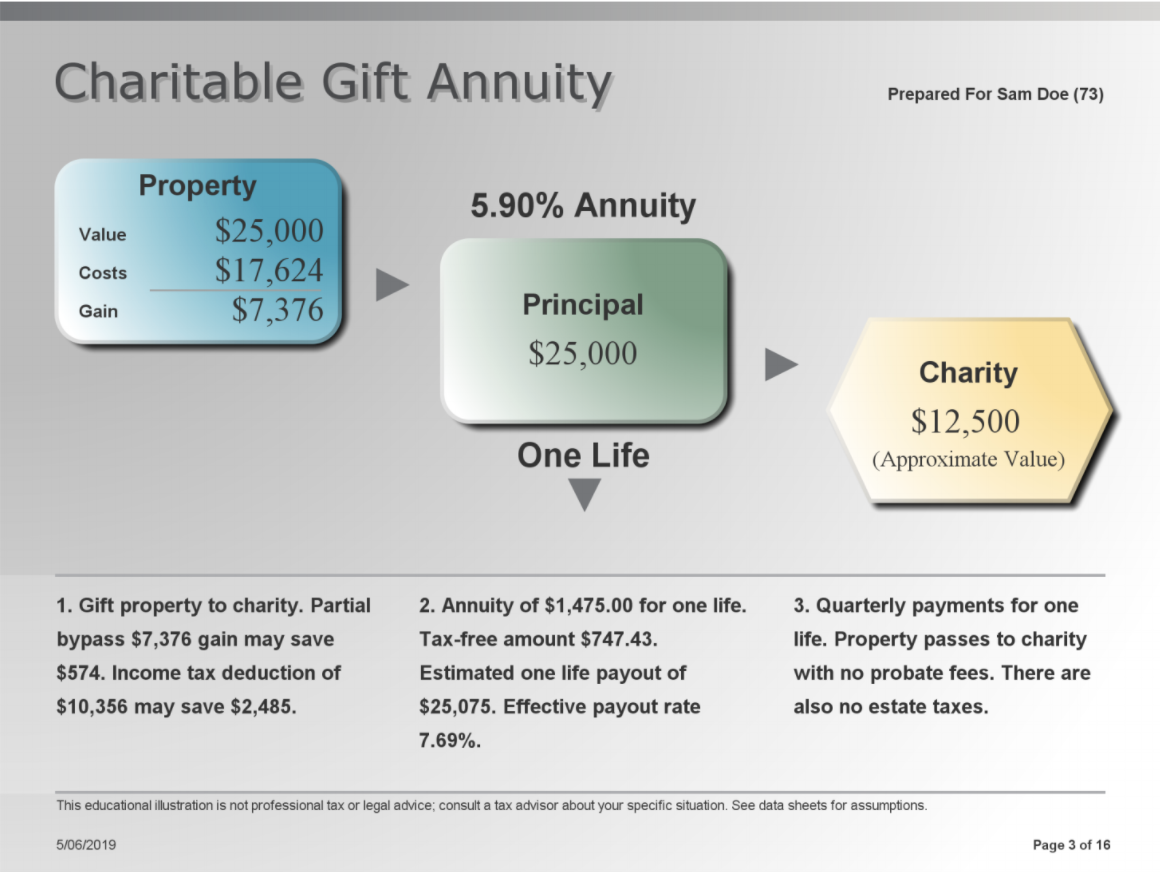

A charitable gift annuity is a contract between a donor and a charity with. If you have a 500000 portfolio get this must-read annuity guide by Fisher Investments. Suppose a donor transfers 1000000 of cash for a charitable gift annuity worth.

Request your free illustration today. Give Gain With CMC. The Charitable Gift Annuity Part Gift Part to Purchase an Annuity.

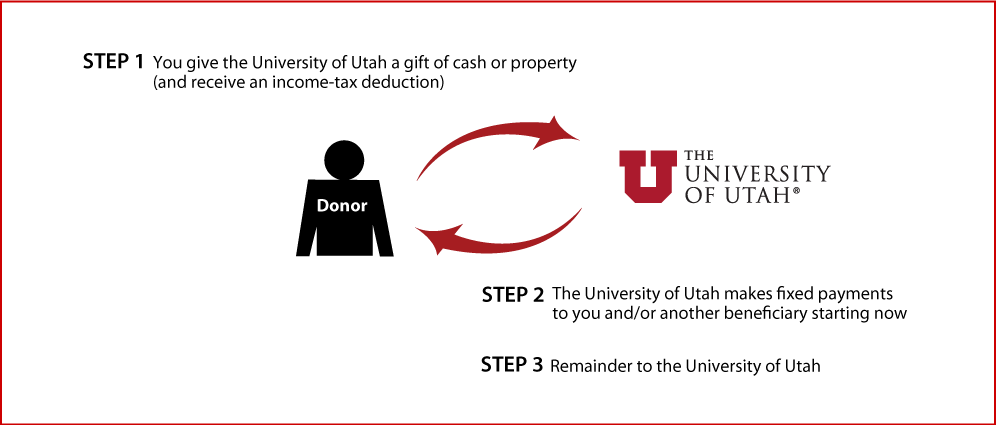

This income will continue as long as you andor your beneficiary survive. Preserves the value of. A charitable gift annuity is a contract between a charity and a donor bound by some terms explained below.

Tax deductions for charitable gift annuities depend on the number of beneficiaries and the age of the beneficiaries at the time. A charitable gift annuity is a contract between you and Jewish Federation of Metropolitan Chicago. When a donor makes a contribution for a charitable gift annuity only part of the gift is tax deductible.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. The Charitable Gift Annuity is at least in part a charitable gift.

Schwab Charitable makes charitable giving simple efficient. Learn some startling facts. Gift Annuity Offers Tax Break and Retirement Income You get a charitable deduction in the year you make the donation along with income for life from the charity.

Get a tax deduction plus guaranteed income for life with a charitable gift annuity. Explore income and tax benefits of an HSUS CGA. Get Your Max Refund Today.

You transfer property to Jewish Federation of Metropolitan Chicago. Ad Support our mission while your HSUS charitable gift annuity earns you income. Ad Explore detailed reporting on the Economy in America from USAFacts.

Request your free illustration today. Those deductions may be more valuable because they can apply at a higher tax bracket. Income tax charitable deduction.

Explore income and tax benefits of an HSUS CGA. Ad Annuities are often complex retirement investment products. How Taxes Deductions on Charitable Gift Annuities Work.

Because it is a charitable gift it generates a charitable income tax deduction for the donor. Ad Support our mission while your HSUS charitable gift annuity earns you income. Ad Bank of America Private Bank Can Help Make Your Philanthropic Vision a Reality.

That makes sense when you consider only part of the gift annuity is a gift to. However unlike other forms of. A contract that provides the donor a fixed income stream for life in exchange for a sizeable donation to a charity.

Taxpayers who itemize deductions can claim a charitable.

Charitable Gift Annuity Eternal Food Foundation

Charitable Gift Annuities The University Of Chicago Campaign Inquiry And Impact

Gifts That Provide Income Maine Organic Farmers And Gardeners

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

City Of Hope Planned Giving Fall Annuity

The University Of Utah Legacy Giving Charitable Gift Annuity

Charitable Gift Annuities Road Scholar

Charitable Gift Annuities Barnabas Foundation

Charitable Gift Annuities University Of Montana Foundation University Of Montana

Charitable Gift Annuity Tax Deductions Cga Rates Renpsg

Charitable Gift Annuities The Field Museum

Nyp Giving Planned Giving Gifts That Provide Income Charitable Gift Annuity Nyp

Charitable Gift Annuities Uses Selling Regulations

What Is A Charitable Gift Annuity Actors Fund

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home